Apple's Stock Price Reaches All-Time High as Warren Buffett Continues to Praise CompanyApple's stock price has established a new all-time high, as shares exchanged hands for

slightly above $187 in intraday trading today.

<img src="

" alt="" width="672" height="449" class="aligncenter size-full wp-image-635150" />

Apple's stock price has been steadily increasing for over a week, driven by the company's

successful earnings report on May 1 and

Berkshire Hathaway buying 75 million additional Apple shares in the first three months of 2018. North American stock markets have also been rallying in general since Friday.

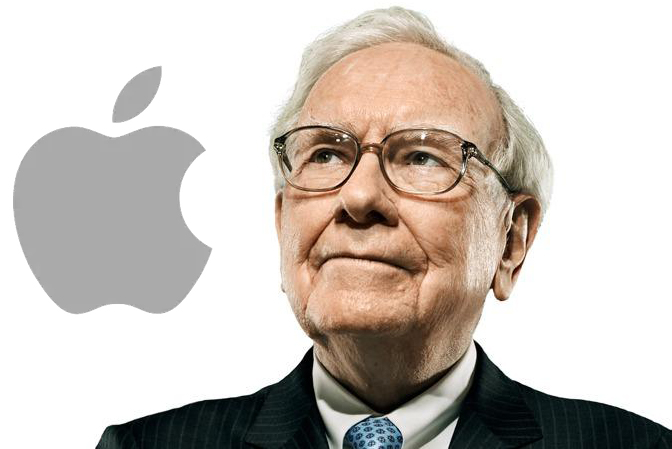

Berkshire Hathaway now holds 240.3 million shares in Apple, worth over $44 billion at the stock's current price, and the holding company's billionaire CEO Warren Buffett continues to praise the company with bullish comments.

"I clearly like Apple… we bought about five percent of the company. I'd love to own 100 percent of it," he quipped, in an interview with

CNBC. "We like very much the economics of their activities, and we like very much the management and the way they think, and the way they act," he added.

<center><blockquote class="twitter-tweet" data-lang="en"><p lang="en" dir="ltr">Buffett on his Apple stake: We currently own about 5% of the company, "but I'd love to own 100% of it"

https://t.co/9SiIuaXfCo pic.twitter.com/A3zsAQfpPu</p>— CNBC Now (@CNBCnow)

May 7, 2018<script async src="

https://platform.twitter.com/widgets.js" charset="utf-8"></script></center>

Buffett was only joking about his intention of owning 100 percent of Apple shares, which wouldn't be possible due to financial and regulatory considerations, but the comment is a testament to his confidence in the iPhone maker.

Buffett wasn't the only billionaire to offer praise, as Microsoft co-founder Bill Gates said Apple is an "amazing company" in an interview with

CNBC, at Berkshire Hathaway's annual meeting. "The top tech companies do have a very strong profit position right now but Apple has the most of all."

Apple now has a market cap fluctuating around the $915 billion mark, as it inches closer to becoming the world's only trillion dollar publicly traded company. Amazon is second closest to that milestone, with a market cap around the $775 billion mark, followed by Microsoft and Google's parent company Alphabet.

In a research note following Apple's earnings results last week, Apple-focused analyst Brian White said Apple remains "one of the most underappreciated stocks in the world with a valuation that remains depressed."

"After the Apple supply chain came crashing down over the past couple of weeks and the market quickly cast an ominous dark cloud over Apple's stock, the company delivered strong second quarter results last night and a solid outlook," wrote White, in a note obtained by MacRumors. "Moreover, Apple minted a new $100 billion stock repurchase program and hiked its dividend by 16 percent."

Looking ahead, Apple's guidance of between $51.5 billion and $53.5 billion in revenue in the third quarter of its 2018 fiscal year would be an all-time high for that period. Its current record for the quarter is $49.6 billion in 2015.

<div class="linkback">Tag:

AAPL</div>

Discuss this article in our forums

<div class="feedflare">

<img src="[url]http://feeds.feedburner.com/~ff/MacRumors-Front?d=yIl2AUoC8zA" border="0"></img>[/url]

<img src="[url]http://feeds.feedburner.com/~ff/MacRumors-Front?d=6W8y8wAjSf4" border="0"></img>[/url]

<img src="[url]http://feeds.feedburner.com/~ff/MacRumors-Front?d=qj6IDK7rITs" border="0"></img>[/url]

</div><img src="

http://feeds.feedburner.com/~r/MacRumors-Front/~4/asmTM5khR-c" height="1" width="1" alt=""/>

Source:

Apple's Stock Price Reaches All-Time High as Warren Buffett Continues to Praise Company