Gartner: iPhone Sales Suffered Worst Quarterly Decline for Three Years Over 2018 Holiday PeriodApple recorded its biggest decline in iPhone sales for almost three years over the holiday quarter, according to new market research data by

Gartner.

<img src="

" alt="" width="800" height="211" class="aligncenter size-large wp-image-665792" />

<img src="

" alt="" width="680" height="219" class="aligncenter size-full wp-image-681358" />

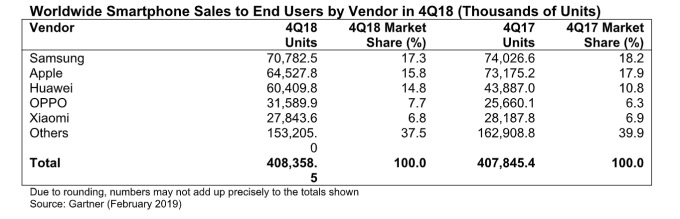

Apple sold 64 million iPhones in the fourth quarter of 2018, down from 73 million in Q4 2017. Those numbers followed a pattern of declining smartphone sales globally in Q4 2018, with growth of just 0.1 percent over the period and 408.4 million units shipped.

Despite retaining its second place position with 15.8 per cent market share behind market leader Samsung (17.3 percent), Apple bared the brunt of the decline, seeing its 18 percent global market share in Q4 2017 reduced to 16 percent in Q4 2018.

The analyst firm said iPhone sales were hit hardest in Greater China, where it found Apple's market share dropped to 8.8 percent in Q4, down from 14.6 percent in Q4 2017. Samsung also recorded a smaller market share over the holiday period year on year, recording 17 percent, down from 18 percent in 2017.

Third-placed Huawei closed the gap on Apple by selling 60 million phones in Q4 2018, up from 44 million in Q4 2017, expanding its share from 10.8 percent in Q4 2017 to 14.8 percent. Oppo, in fourth, registered 7.6 percent, up from 7.3 percent in Q4 2017, while Xiaomi took a 6.8 percent share, down slightly from 6.9 percent the previous holiday quarter.

"Demand for entry-level and midprice smartphones remained strong across markets, but demand for high-end smartphones continued to slow in the fourth quarter of 2018," said Anshul Gupta, senior research director at Gartner. "Slowing incremental innovation at the high end, coupled with price increases, deterred replacement decisions for high-end smartphones."

<img src="

" alt="" width="680" height="207" class="aligncenter size-full wp-image-681359" />

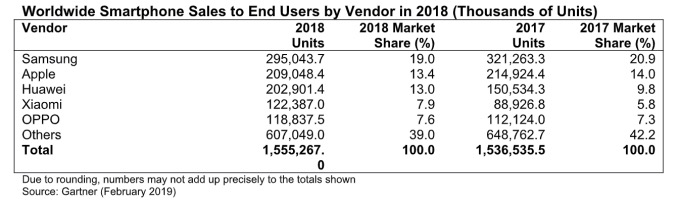

For 2018 as a whole, global smartphone sales grew by 1.2 percent year on year, with 1.6 billion units shipped. Market leader Samsung saw a 1.9 percent decline in share and Apple lost 0.6 percent over the previous year, but Huawei, Xiaomi and Oppo all saw overall gains of 3.2 percent, 2.1 percent, and 0.3 percent, respectively.

According to Gartner, Chinese brands actually boosted their overall sales thanks to broad appeal in emerging markets like China and India, while the worst declines of the year took place in North America and mature Asia/Pacific market regions.

Beyond the overall slowdown in the smartphone market, Gartner put Apple's poor quarterly performance down to buyers delaying upgrades and compelling alternatives from Chinese vendors.

"Apple has to deal not only with buyers delaying upgrades as they wait for more innovative smartphones, but it also continues to face compelling high-price and midprice smartphone alternatives from Chinese vendors. Both these challenges limit Apple’s unit sales growth prospects," said Gupta.

Last month, Apple issued a

rare warning that revenue for the quarter would come in at least $5 billion below the company's original guidance, with Apple pointing to a number of factors including the later launch of the

iPhone XR, general weakness in China, and fewer upgrades as customers took advantage of Apple's reduced pricing on battery replacements in 2018 to extend the lives of their current phones.

Apple later

posted revenue of $84.31 billion and net quarterly profit of $19.965 billion, compared to revenue of $88.3 billion and net quarterly profit of $20.1 billion, in the year-ago quarter. However, even with the earnings warning, the quarter was the second-best in Apple's history in terms of overall revenue and profit, trailing only the first fiscal quarter of 2018.

Apple CEO

Tim Cook recently said that the company is "

rethinking" iPhone prices outside of the United States and may lower prices to boost sales. Apple has already started lowering the price of the iPhone for third-party distributors

in China, and price cuts could also be introduced in other areas like India and Brazil, where the iPhone is prohibitively expensive and has seen stalled growth due to high pricing.

<div class="linkback">Tag:

Gartner</div>

This article, "

Gartner: iPhone Sales Suffered Worst Quarterly Decline for Three Years Over 2018 Holiday Period" first appeared on

MacRumors.comDiscuss this article in our forums

<div class="feedflare">

<img src="[url]http://feeds.feedburner.com/~ff/MacRumors-Front?d=yIl2AUoC8zA" border="0"></img>[/url]

<img src="[url]http://feeds.feedburner.com/~ff/MacRumors-Front?d=6W8y8wAjSf4" border="0"></img>[/url]

<img src="[url]http://feeds.feedburner.com/~ff/MacRumors-Front?d=qj6IDK7rITs" border="0"></img>[/url]

</div><img src="

http://feeds.feedburner.com/~r/MacRumors-Front/~4/N_IT1EvcEvc" height="1" width="1" alt=""/>

Source:

Gartner: iPhone Sales Suffered Worst Quarterly Decline for Three Years Over 2018 Holiday Period